At the beginning of every new year, one of the first things I do with our finances is to take a hard look at our budget and see where we can get the most bang for our buck.

At the beginning of every new year, one of the first things I do with our finances is to take a hard look at our budget and see where we can get the most bang for our buck.

At first this usually involves doing the normal thing that most people do – taking a look at our bills and seeing where we can shave some expenses. But there’s something else I like to do with the extra money in our budget that I feel is just as important as cutting corners on expenses. I like to take a look at where we can best grow it!

There are lots of good options for what to do with extra money if you’ve got it. You might apply it to some kind of debt you have so that you’ll end up saving a boat-load in interest payments (after all, saving money can sometimes be just as powerful as growing it). Or you might straight-up decide to invest it. Regardless of whatever you choose to do, one thing is for sure – there will be a choice that calculates out to have a higher return than the others.

So if you’re anything like me and wondering what to do with a little excess money this year, let’s layout a few smart options and see which one works out to make us the most money in the long run. This year I’ve got about $200 per month of extra money to do something with, so that’s the number we’ll be using for our choices going forward (you can of course insert whatever number you’ve got and follow along).

There are three very respectable paths I’d like to explore. They are:

- Paying a little extra each month in mortgage principal

- Buying up more stocks

- Increasing our 403b retirement contribution

All three are good! But let’s dig a little deeper into each one and see how the numbers might actually play out over the next few years.

Option 1 – Paying a Little Extra Mortgage Principal Each Month:

Without even thinking about it, this was the very first thing I wanted to do with the extra money in our budget.

Why? Because everyone knows it’s a great thing to pay off your mortgage early if you can help it! Who doesn’t want to pay down that debt and be 100% owner of their own home?

We all know that we can avoid tens of thousands of dollars of interest AND shave years off our mortgage payment schedule if we can just bring ourselves to send in a hundred extra dollars on top of our regular mortgage payment. If you don’t think so, play around with this calculator and see for yourself what a few extra hundred dollars will do to your mortgage over time. It’s pretty amazing!

Plus paying off my mortgage early supports my initiative to retire early. Just think about how much less money you’d need for retirement if you no longer had to pay a mortgage payment every month.

What Is An Extra Principal Payment Worth Exactly?

One of the great things about applying extra money to your mortgage principal is that from an investment perspective you effectively “lock in” to a rate of return that is equal to your long-term mortgage interest rate.

For example, my mortgage is a 20-year fixed at 3.75%. Therefore whatever extra money I pay forward would be the investment equivalent of getting back 3.75% annually. (By the way, this also works out for high interest debt. For example if you had a credit card that carried a 20% APR on the balance, each extra principal payment you made would be like getting a 20% return. That’s why financial advisers always advise paying down your highest balance debt first.)

The other bonus – when you pay down your down at some fixed interest rate, you’re essentially locking into that fixed rate risk-free! (Because the terms of the debt were already pre-arranged.) That’s not too bad when you consider there aren’t a whole lot of other investment products out there that can claim a 3.75% risk-free return. Have you looked at how poorly CD’s pay lately?

Option 2 – Buying More Stocks:

This was the second thing to come to mind. Since I invest for the long-term, there’s really no reason why I couldn’t take that extra $200 per month, save it up, and then make a dynamite $2,400 lot purchase.

Plus building up my stock portfolio is another big component of my plan for early retirement because it will give me access to income that I can withdraw from anytime I want (unlike how you need to need to wait until age 59-1/2 with your tax-deferred retirement accounts).

What Kind of Return Could I Expect?

I like investing in stable, dividend-paying stocks because I know they classically have a good record of producing consistent returns; approximately 8% year over year when you look at the long-term. Earning closer to an 8% return sounds much better than earning only 3.75%.

But the trade-off here is of course “risk”. Unlike paying off the mortgage early where each extra principal payment is a fixed reduction of interest, stocks don’t work the same way. The stock market is more of a game – realistically anything could happen.

According to the S&P500 returns, the 10-year average annualized returns for the past 40 years could be as high as 19.21% or as low as -1.38%. That would be really unfortunate to invest for 10 years and lose an average of -1.38% year over year by the end of it. So with this option there are some more serious risks and rewards to consider.

Option 3 – Increasing Our 403b Retirement Contribution:

As I was considering the above two options for what to do with our extra money, I re-read one of my previous blog posts and realized that perhaps I had a third and even better way to make this extra cash really grow!

Out of all our retirement accounts, my wife’s 403b (i.e. the government version of a 401k plan) is the only retirement account that we are not currently maxing out. We still have some room to increase our contribution rate before we’re maxed out at the 2015 IRS limit of $18,000 per year.

But with this option there might be a little something extra as far as strategy goes …

Isn’t This the Same Thing as Option 2?

Our 403b is invested mostly in just whatever stock / bond index related funds are available within the offering. So again we could probably assume an approximate 8% return on whatever money we pour into this option.

And that probably leaves you wondering: Won’t this be just the same thing as Option 2 where we were investing in stocks?

The answer – no.

Remember with a 403b (like a 401k) you get a special tax incentive to save your money for retirement BEFORE taxes are taken out. That will not be the case with the first two options. In Options 1 and 2, I’d be using post-tax money (i.e. the money that’s left over in your paycheck) to pay my extra mortgage payments or invest in stocks.

So since the 403b option is pre-tax money, in reality I’ll have “more money” to effectively save each month without our family budget ever even feeling a ding.

How much more extra money?

Consider that in Options 1 and 2 I was planning to divert $200 per month after taxes ($2,400 per year).

If we assume I’m in the 25% tax bracket, really I’ll have $200 x (1 / (1-0.25)) = $267 per month pre-tax to save ($3,200 per year).

And as you can guess, more capital will certainly be better to work with because that will only help lay the foundation for bigger returns.

The Decision of What to Do With Extra Money in Our Budget:

Like I said – all 3 are good, strong options. But we can only choose one of them.

And so after all that, which choice will hypothetically calculate out to the better option? Here are the results:

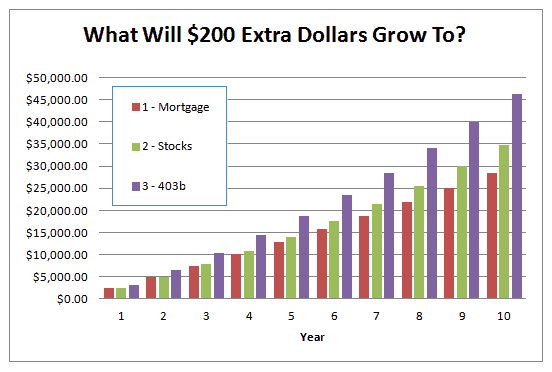

As you can see over an anticipated 10 year stretch:

- Option 1 will save me a respectable $28,483 in total interest. That’s not too bad.

- Option 2 will have a much stronger potential to grow and could work out to as much as $34,768. That’s $6,285 (22%) more than Option 1. However the trade-off is that I’d be taking on a lot more risk.

- Option 3 will have the best potential for growth possibly reaching as high as $46,357. That’s $17,874 (63%) more than Option 1. Again, there would be the risk factor to consider. But the tax-savings incentive really helps to give this one the biggest boost.

So Which One Did We Decide to Go With?

I’m always gunning for the long-term. So I will go with Option 3 and increase our 403b contribution.

Even though I’d love to pay off our house sooner and build up my stock account as high as it can go, the simple fact is that you just can’t ignore how much greater the potential for your money to grow is with Option 3. The tax-deferment helps increase the size of the capital and the investment strategy puts it right on par with how the stock market does. So this will be the one we put our extra $200 per month towards.

Hopefully the next time you’re considering what to do with extra money in your budget, you can look back on this post and see that sometimes the answer requires a little bit of digging. But when you’re talking about tens of thousands of dollars more over time, that helps make it worth the time and energy to thoroughly investigate your options.

Readers – What would you have done with the extra money in your budget? Would you have made a different choice? Would you have picked something else we didn’t even discuss?

Featured Image courtesy of Thomas Guignard | Flickr

The post What To Do With Extra Money In Your Budget – 3 Good Choices appeared first on My Money Design.