It’s occurred to me on several occasions that not everyone reads money magazines or CNN Money as much as I do. For some people knowing where to start is practically half the battle when it comes to getting a grip on your finances.

It’s occurred to me on several occasions that not everyone reads money magazines or CNN Money as much as I do. For some people knowing where to start is practically half the battle when it comes to getting a grip on your finances.

What they need or would love to see is a sample financial plan that just gives them the hard numbers! They need something that could use as an example for how you should be saving and spending your money. That’s exactly what I wanted to do in this post.

For one second, let’s put aside the whole, touchy-feely, fluffy notion that every plan is unique. It is (don’t get me wrong)! But there are some general figures that you could go by that may not be so bad.

If anything, consider them a good starting point.

Your Personalized Sample Financial Plan:

Over time we’ve collected a number of metrics here on My Money Design that make great places to start when setting up your financial plan. Here they are (based on percentages of your gross income):

Long Term Savings: 12%.

This would be for something like retirement.

It has been demonstrated by financial academia that saving 17% of your gross income for 30 years gives you the best possible chances of making your retirement income last for 30 years or more, despite whatever market conditions come and go.

While it would be great if you could hit 17%, that might be a little bit of a stretch for someone on a limited income or other priorities. In that case, I’m suggesting that a minimum of 12% should be sufficient. You might have to work longer than 30 years or be willing to take on more risk. But that is the tradeoff that comes with saving at a lower percentage rate.

You don’t need to do anything fancy to save for retirement. Just put the money in your employer 401k and IRA retirement funds, and invest it in a few stock and bond mutual funds that follow the market indexes.

If you’d really like to increase your chances of success, make sure you’re doing everything necessary to get your maximum 401k employer matching contribution. Don’t pass up the opportunity to take advantage of free money if someone is offering!

Short Term Savings: 4%.

This would be for your emergency fund. Bad stuff is going to happen. Your car will die. Your furnace will go out. There will be surprise expenses in your bills. (By the way – these aren’t things I made up. All of this really happened in the last six months to me.)

If you can save a minimum of 4% of your income for short-term emergencies, you’ll have a great start to a cushion that will help you to take on situations like this without a lot of headache or going into debt.

College Savings: 2%.

Although saving for retirement is usually a higher priority, you can’t help but want to make sure your children start off their adult lives with the best financial footing possible. And that means finding a way to make sure they don’t go to college with loads of financial debt. Start as early as possible by putting aside a healthy number such as 2% of your income (per child) into a college savings plan such as a State sponsored 529 plan. It may not pay for everything. But in eighteen years, you’ll be glad you did as much as you could.

Insurance: 3%.

Although it’s not necessarily an investment, nothing protects your assets and financial well-being quite like affordable insurance. Make sure your family has adequate health, life, home, car, and disability insurance.

Start by finding out which ones your employer offers. A lot of professional jobs offer health, dental, and disability. When you look at how much these services cost out of pocket, you may even want to consider switching to a job that does cover these. A lot of companies with foreign based headquarters are willing to offer benefits that surpass a level you might be accustomed to.

Whatever they don’t give you or provide enough of, you’ll likely have to buy it on your own. Usually for about 2 to 4% of your pay you can find reputable car, home, and life insurance. Usually if you get it all from the same place, you often get a discount.

Mortgage: 25%.

If you have or are planning to have a mortgage, try not to let it exceed a maximum of 25% of your gross income. Reports have shown that anything above this amount tends to stress the family and leave little room for their other financial goals. That includes your escrow with taxes, insurance, etc.

A Better Financial Plan Depends On More Income:

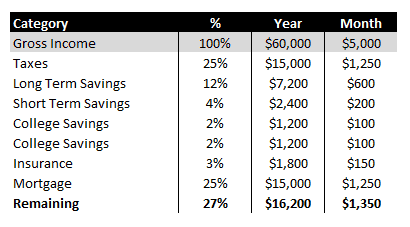

So let’s suppose you make the average $60,000 income. Here is a summary of what your sample financial plan would look like if you use the percentages above.

If you don’t like what you see, then there are only two things you can really do to improve your financial plan:

- Minimize your expenses

- Make more money

On the “make more money” side, this doesn’t have to come from getting another job or anything like that. What it takes is the ability to buy things that will produce money for you. We call this passive income because its money that can be made without you having to get another job or putting forth a lot of extra work. An example might be the dividend income you take in from stocks, rental income from your rental properties, or even advertising income from a website you created. If you’d like a whole list of suggestions, check out my page of passive income ideas.

This Was Just A Sample – Your Plan Should Fit YOU!

Remember that this whole financial plan was just a sample, not a set of rules of follow. In reality your spending and saving goals should really fit YOUR needs and not just follow some arbitrary percentages. Take these figures and twist them up or down in a way that works for your needs.

The important thing is to actually give each of these categories some thought and have adult conversions with your significant other about this. The sooner you have a plan for where your money is coming and going, the sooner you can get a handle on how hard it will work for you!

Readers – If you had to put together your own sample financial plan to help another, how close would your percentages come to these values?

Image courtesy of FreeDigitalPhotos.net

The post A Sample Financial Plan – How Should You Budget Your Money? appeared first on My Money Design.